LOBSTR Trading 101

Getting Started:

It's very easy to feel overwhelmed when approaching the subject of trading for profits. But it doesn't

need to be that way. With a few easy pointers and some experience, you can be trading like the

pros as quickly as you learn. The following tutorial will give you a solid start to trading on Stellar

Lumen's LOBSTR platform.

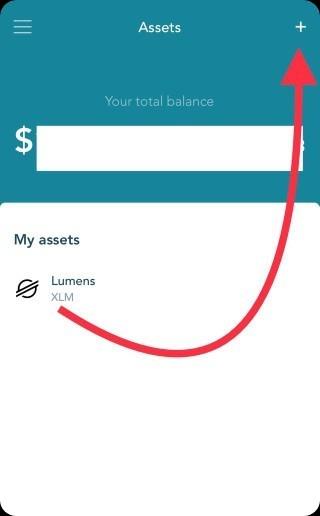

First thing you’ll want to do after setting up your LOBSTR account, is head over to the plus icon for

your asset screen.

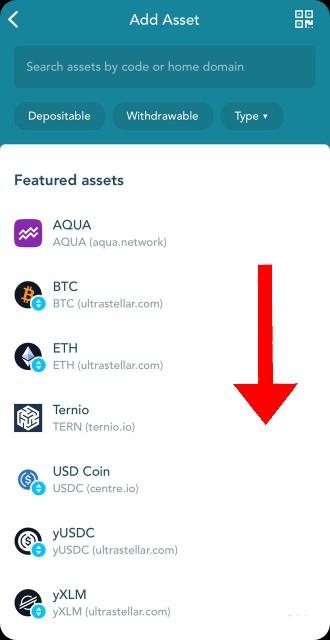

That’ll lead you to the Featured Asset screen. Scroll down further.

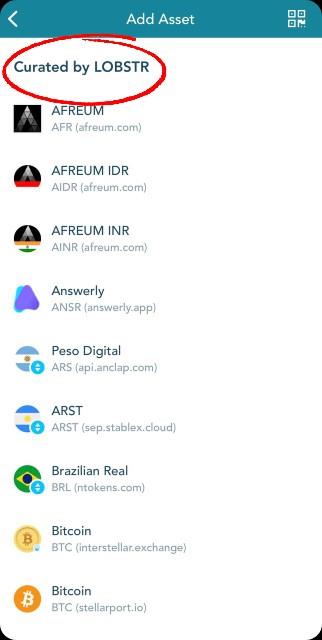

Here you'll find all the LOBSTR Curated Assets. Stick to trading only amongst this category until

you've built enough confidence to trade in higher risk, unverified tokens. (If at all) There are a few

tokens here and there that have garnered trust amongst our group, but primarily this will be your

investment grouping. Curated Assets have stood the test of time and offer real liquidity.

My advice (that isn't financial advice) is to add all the curated assets to your wallet. This will cost a

bit of XLM, but having all the curated assets in your wallet to monitor is crucial to the process.

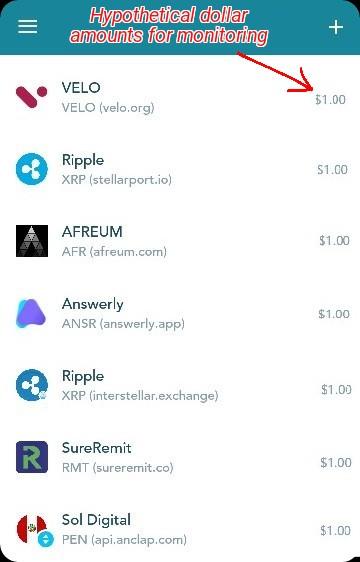

Having actual amounts in each of the curated assets is going a step further. That enables you to

monitor the various rates in all curated assets at a glance. If you can afford it, I’d start out putting

one dollar amounts in each. If that dollar booms, you're seeing a high. If that dollar drops, it's a buy

point. Then again it's all about WHEN you placed that dollar in the asset. Buy high and you can

expect a fallout. Buy low and you might just see instant gains. (I'm using the dollar amounts as a

guide only so you'll understand how to read these amounts at a glance in high/low terms)

Build Slowly; The Turtle Wins The Race

There's no need to rush the process of “getting in”. On the contrary, the slower and more

calculated the better. Starting out, you may find yourself only making a few moves a day. Later on

with a full spread of assets, you may find yourself constantly skimming and reinvesting. Really it

depends on your level of experience and involvement.

Pro Tip: When starting from a deposit amount, keep your funds stored in Stablecoins until you can

spread them amongst the curated asset lows. Trusted Stablecoins are as follows:

Current LOBSTR Curated Assets

Current updated curated list from LOBSTR. List is subject to change and scrutiny. Stay tuned for

special remarks dealing with curated assets with asterisks.

LOBSTR Curated Asset Complete List

Now That You Know The Playing Field…

What comes next?

Well at this point you should have a minimum of curated assets added, with or without test

amounts in each. Again, the amounts aren't important, and are only used as a glance reference.

The market never sleeps, and timing is key. Every little curve helps.

Another minimum to have on deck is funds (quite obviously). Doesn't matter what assets they are.

If you're holding to move into these curated lows, I suggest Stablecoins until you get acquainted.

If you don't want to use test amounts or add all the curated assets right out the gate, you can also

monitor Liberty Crypto Syndicate (LCS) for lows to be called out in real time as they happen. We

use a combination of finding lows manually, and using TREAD (LCS token) to find lows in real

time. (Often faster than LOBSTR updates pricing, as Stellarium Bot is always first to notify.)

Feel free to join us at LCS, the more people with eyes on the market, the faster it is for our

community to utilize the information.

https://discord.gg/S3eYSqvA

Let's Play Ball…Strategy Time.

• Finding Lows

First step is identifying what a low actually is. And how often you're planning to make trades.

Maybe you'll go for the long game and only buy radical dips. Maybe you'll be the type running

micro trades all day. Whatever your game plan is, finding lows is as easy as monitoring the

charts and your asset balance.

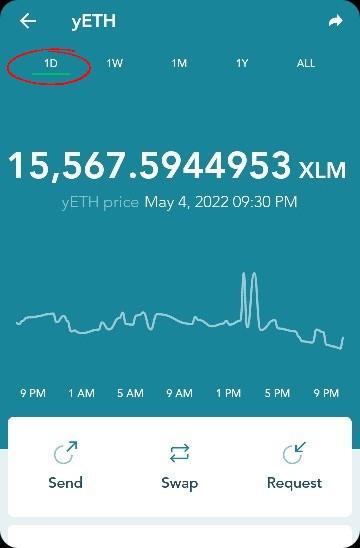

IMPORTANT NOTE: What looks like a dip in one chart could actually be a small dip in a

previous high. Know your charts per asset, and try to get accustomed to the average price

fluctuations. There are a total of 5 chart times to observe: Day, Week, Month, Year, and All.

Primarily we’ll stick to Day/Month/Year.

Following is an example from Day/Week/Month for yETH. As you can see, what looks like a dip

in the day chart is still pretty high:

• Identifying Lows Per Asset

Now that you know the different time periods of charts to identify lows, the next step is to dive in

and look for buying ranges.

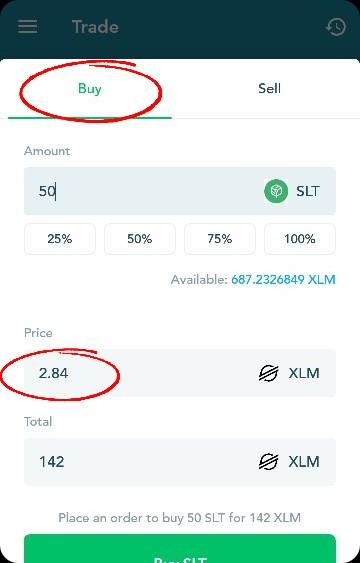

SLT will be used in the following example:

SLT crashed to 2.84 or so. This is an excellent range for SLT buying points.

Meanwhile you can see the recent high was over 4 XLM. Meaning the movement potential here is

a no brainier. For dips like these, I stack the bag deeper. Not necessarily recommended to do so

starting out, as you'll want to balance between diversifying across all curated asset lows, and

stacking your bags at just the right time/amounts to pull profits. Seems complicated but comes

easily with experience.

Follow the charts and diversify into lows carefully. Same routine for every asset. You'll begin to

learn what assets move more than others, and where your efforts are rewarded heaviest.

Sometimes there are no highs, but there are lows you can't pass up. In that case choose from

something heading sideways in the charts, or stables/metals you've reserved for such an occasion.

Thinking ahead will get you everywhere in this market.

Surrounding yourself with experience is the best strategy. Fake it till you make it. We’ll give you a

cheat sheet on all the highs/lows we are tracking in LCS in real time. Follow along in the group and

you'll have this process down in no time.

• Skimming (AKA Pulling Profits)

There is an easy equation with “How” to go about skimming profits from asset's high. It starts with

buying as low as possible. And it continues with knowing how/when to sell.

When to sell is the easy part. Through monitoring the charts the same way you found the lows,

you'll find the highs. Monitoring the value increase from your wallet really helps. Use the group as a

cheat sheet for highs as well.

How to sell is a bit trickier, but comes natural after a few pointers and experience. There are some

guidelines I've learned to use that will help.

• First- If you're just starting out, the goal is to build up the base of ALL curated assets.

Diversity is key. Keep 50% of whatever asset you're holding as your base at all times. The

more trusted assets you have to work with, the more opportunity will be knocking.

• Second- Never sell your other 50% at the first sign of a boom. Sell up to 25-30% (size of

boom depending) and wait. Whether that means selling one 25-30% chunk, or selling it in

smaller…say 5-10% quantities as it rises. You'll want to skim but maintain both the base

amount, plus more for skimming if the high reaches higher. Many small movements are

often the most profitable.

• Third- Skim immediately into lows when possible. The less transaction “hops” the better.

When lows are hard to find, use Stablecoins to hold your skim profits. Or if you see

XLM/Metal lows, now might be a good point to skim into them. Again, the group is a good

cheat sheet if you’re looking for lows in the moment and can't find any. But with amounts in

all the curated assets and everything being visible from your wallet, it shouldn't take long

before you’re spotting the lows in real time. Learn to eyeball all your amounts.

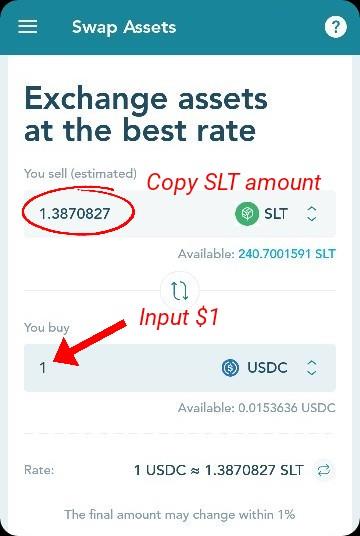

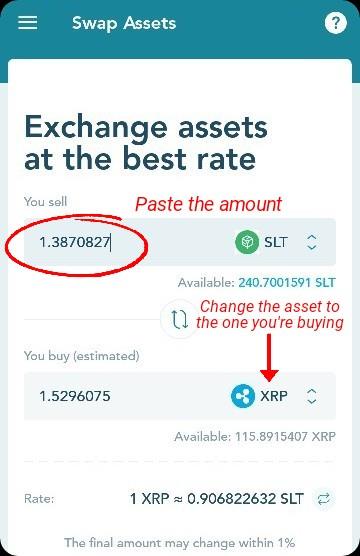

Now that you've learned a very organized pattern to your skimming, it behooves me to show

you an easy way to find the dollar amount you’re wanting to skim.

Simply head to the swap, and look up whatever asset you're looking to skim, paired with USDC.

Copy that amount, and paste it, once you switch USDC with the low asset you’re looking to sell

into.

SLT $1 skim example:

It's as simple as that. Use USDC as your guide until you get more used to the different curated

assets. Soon you won't need the USDC guide at all, and you'll be swapping out curated assets on

the fly. I think of my total asset amounts in terms of percentage, and adjust accordingly. Although

I'll still use the USDC guide on occasion.

• Holding The Base; Growing The Base

Following the format touched on earlier, hold a consistent base of 50% in all your assets. The other

50% is for selling off into other lows. Sometimes you'll sell less, and that’s fine. Moving strategically

is key, while consistently growing your base. Each cycle of buying low and skimming high, will

raise your base in the assets you're utilizing. Consistently growing your wallet across the board.

I liken it to cloning plants. When the bush gets too tall, trim the branches and put them back in the

dirt. Easy peezy.

Holding your base and reinvesting into lows, not only helps your wallet, but the entire stellar

community. You are helping stabilize pricing and growing real liquidity of the network itself.

• Dueling Assets; Market Staples vs Metals/Stables

Simplest explanation: The entire market follows BTC. When BTC goes up, so does the entire

market. When the market goes up, Stablecoins and Metals deflate and flood back into the market.

On the flip side, Stablecoins and Metals boom as the market deflates. This is a constant cycle, and

if you know what to move and when, you can make a decent profit margin just from moving

between main market staples and stable/metals. Predictable patterns in crypto are some of the

most profitable. The following is an example of XLM, USDC, & GOLD charts recorded at the same

time.

All price movement can be used to capitalize. This is just one example. I'll often find myself

checking yXLM lows to move XLM into, whenever those dips happen. When the price bounces

back, I'll sell back into XLM. Easy way to grow your XLM small amounts at a time (this is where the

order book comes in handy). There are hundreds of different pairing methods. Just like before,

expertise will come with experience.

• Utilizing The Order Book

For this tutorial I've stayed away from a full explanation of the order book. I'll include a tutorial on

the subject soon. (As it deserves an extensive tutorial to itself) But I'll touch on it briefly here.

The order book is the most powerful tool you can use to maximize movement potential. And it's

especially handy for those who can't monitor the market 24 hours a day.

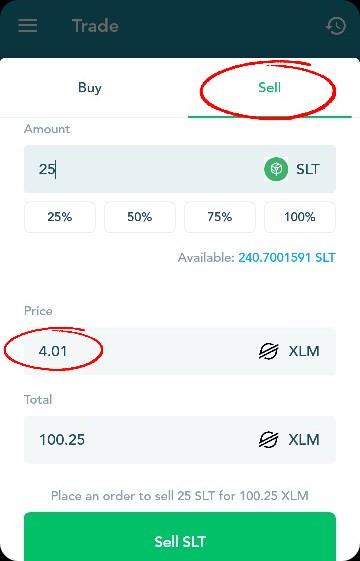

We’ll use the SLT lows and highs from earlier we identified, to set the orders as an example.

• First head to the trade screen and make the trading pair SLT/XLM. We’ll cover Buy SLT

first…

• From the low earlier, we've identified SLT dipped to 2.84 XLM. So we’ll set a buy order at

2.84 hoping for a dip. For those wanting to set buy orders for bigger dips, maybe you set

buys at 2.8-2.5 XLM. Maybe you think there will be less of a dip. So you set orders for 3.2

XLM down to 2.9 XLM…running as little as one order, or a whole ladder of them. You can

set as many orders as you want (up to 1,000), just know that the amount of whatever you're

selling from, will be in reserve till the order is filled. (In this case, 142 XLM) Now to the sell…

• From the SLT high we identified earlier, now we're setting a sell order for SLT at 4.01 XLM.

Again, as with the buy side, you can post as many sell orders as you have the asset

reserves for. Think SLT will go into the sky? Set a sell for 4.5 XLM and up. Want to skim a

bit earlier? Have a sell set for 3.9 XLM. You'll get a feel for it as you go. On this side of the

trading pair, it will be SLT being reserved.

Remember to stick with the formula of holding your 50% base, and skimming appropriately when

creating orders (just like you would in the swap). You can also create very small orders to help you

identify highs and lows without moving much around. Say you set a buy and sell order for penny

amounts. You'll still be notified of the orders filling, while you can check the charts and decide how

you'd like to proceed manually. All depends on how you decide to use the order book.

Play The Game Responsibly…And Don't Forget To Have Fun

As history has shown us, get rich quick schemes hardly ever pan out…and hodl only tactics will

have your wallet bleeding.

Don't ever put you or your families future finances on the line, hoping to make it big overnight.

That's gambling, and it's a gamble you'll lose 99.9% of the time. Remember the house always

wins. This is called a casino for good reason.

You get ahead in this race by being the turtle; slowly and surely growing while maintaining

personal financial stability at home.

There are always strategies for those willing to learn. And nearly infinite ways to apply the

information in this tutorial. And we've just begun. I'll be making more tutorials in the future, let me

know what topics you’d like covered.

Feel free to browse this and other tutorials at:

http://donttreadtoken.com/

If anyone has questions regarding the info covered in this tutorial (or any other questions) feel free

to join our group Liberty Crypto Syndicate https://t.me/libertycryptosyndicate