TREAD & LFI Storm of Value: Market Movement & Liquidity Shifting

TREAD & LFI offer some of the finest incentives for providing liquidity in Stellar Lumens network. But after pooling your Storm of Value Rewards pairs, what other ways can you utilize your pools to maximum benefit? In this short tutorial we'll explain market movement, and how to go about shifting liquidity to your advantage while staying inside your rewards pairs.

By utilizing the methods in this tutorial you will not only benefit your own wallet. You are providing healthy support for the TREAD & LFI ecosystem, our community partnerships, and the whole of Stellar itself. The strategies that follow are the exact same as how the foundation of TREAD & LFI were built utilizing market movement to their advantage.

Let's begin.

Getting Started:

First, you'll need to have TREAD or LFI rewards pairs already established. If you don't already have rewards pairs pooled, you can check the current list at https://donttreadtoken.com/index.php/stellar-rewards

Pooling is easiest through StellarX. And you'll get the added benefit of .3% fees for providing liquidity through StellarX. For a direct link to StellarX liquidity pools, follow this link: https://www.stellarx.com/amm/liquidity

Use your LOBSTR Email and password to log in. Or use the wallet connect feature inside of LOBSTR.

Before pooling, make sure you have both sides of the assets you wish to pool. Swap fees can be avoided by using the swap feature in StellarX instead of LOBSTR’s swap feature. StellarX swap can be found here https://www.stellarx.com/swap

How to Utilize Market Movement in your TREAD & LFI Rewards Pairs:

For the sake of simplicity, we're going to assume you've already pooled TREAD and/or LFI rewards pairs. If you need help setting up your pools, please visit us at https://t.me/libertycryptosyndicate for more details.

Market movement and liquidity shifting may sound complicated, but it's actually pretty self explanatory. By paying attention to the movement in the market, you can make the most out of your TREAD & LFI rewards pairs by shifting your liquidity pools accordingly. But we'll get into examples and detail the process as follows using the base assets of XLM & USDC:

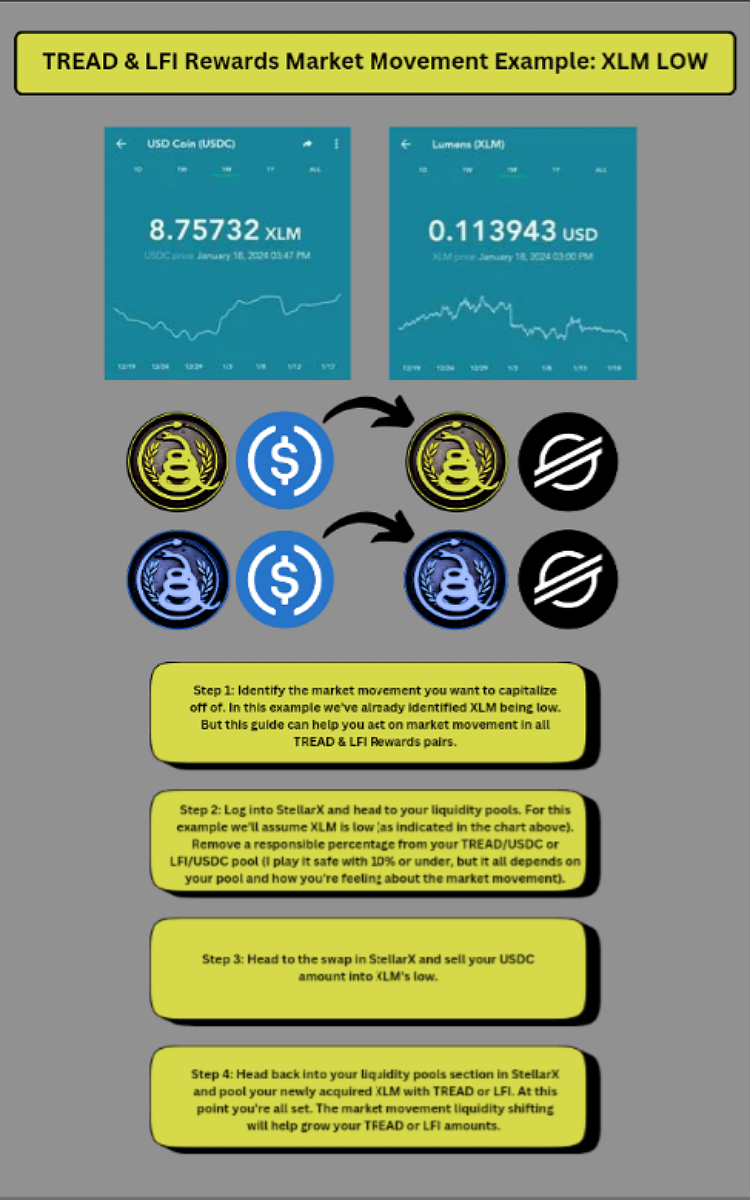

XLM Low Example:

Shown in the above picture example are 4 steps to shifting your TREAD and/or LFI rewards pools between USDC and XLM during low rate movement by XLM.

1st Step: Identifying the low XLM rate movement.

2nd Step: Remove a responsible percentage of your TREAD/USDC and/or LFI/USDC pools.

3rd Step: Swap your USDC for XLM.

4th Step: Re-pool your XLM with TREAD and/or LFI.

And as easy as that, your USDC rewards pools have shifted liquidity into XLM rewards pools and capitalized off the low rate movement of XLM.

XLM High Example:

Shown in the above picture example are 4 steps to shifting your TREAD and/or LFI pools between XLM and USDC during high rate movement by XLM.

1st Step: Identifying the high XLM rate movement.

2nd Step: Remove a responsible percentage of your TREAD/XLM and/or LFI/XLM pools.

3rd Step: Swap your XLM for USDC.

4th Step: Re-pool your USDC with TREAD and/or LFI.

After Step 4 you have successfully taken responsible profits from XLM to safeguard in USDC, and protect your TREAD and/or LFI pools from impermanent loss as XLM deflates. Safeguarding your pools. Now when XLM comes back down to it's support level, you can utilize the steps in the “XLM Low” example to start the process all over again and build up both your XLM and TREAD & LFI side of the pools.

If the process sounds repetitive, it's because it is. And once you try it a few times, it'll become second nature.

Other Rewards Asset Applications in Liquidity Shifting & Market Movement:

The examples we've already covered are for XLM & USDC pairs. But these methods can be used on every TREAD & LFI Storm of Value Rewards pairs listed.

Examples:

BTC (ultrastellar.com) is experiencing movement. Switch out the “XLM” examples above for BTC and the same methods apply.

ETH (ultrastellar.com) is experiencing movement. Switch out the “XLM” examples above for ETH and the same methods apply.

And on and on and on. The relationship between USDC and any main market rewards pairing is crucial to understanding how to make market movement work for your TREAD & LFI pools.

But it doesn't have to just be that specific USDC relationship.

Examples:

XLM is booming upwards without drastic movement from BTC or ETH. You can shift some XLM profits back into BTC and ETH and re-pool with TREAD & LFI.

XLM is staying down in rate while BTC & ETH have been moving upwards. You can shift your BTC & ETH rewards pairings into XLM and re-pool them with TREAD & LFI.

BTC has boomed while ETH has remained lower. Could be a good time to shift some BTC into ETH and re-pool with TREAD & LFI. Vice versa, ETH is booming at a higher percentage than BTC. Good time to shift from ETH to BTC.

You get the picture at this point. All the rewards pairs can be shifted based on market movement with just a little effort and market homework.

Liquidity Shifting Benefits:

There are numerous benefits to employing these strategies as the market moves.

For starters, you are benefiting yourself as a holder in TREAD & LFI rewards pairs. By shifting based on movement, you grow your TREAD & LFI side of the pool as the other pairing recovers and gains in rate.

As stated in the intro, these are the same exact market movement tactics that helped develop the foundation of TREAD & LFI. Not only are these healthy strategies for your rewards pairs, but they are crucial to the very foundation of TREAD & LFI. Responsible market movement helps grow the overall rate and liquidity in TREAD & LFI; and by proxy, bolsters growth in our community and the entirety of the Stellar ecosystem.

Tutorial Summary:

By now you should be well versed in how utilizing market movement and shifting responsible liquidity serves to the benefit of all.

We have identified the steps to identify movement in any rewards asset, shift pools and swap accordingly, and complete the process by re-pooling and building your rewards assets stronger.

Remember to shift responsibly and stay diversified. Having a full spread in your TREAD & LFI rewards pairings means you can act on every opportunity that presents itself.

If you have any further comments or questions about this tutorial, or any other inquiries whatsoever, please join us at https://t.me/libertycryptosyndicate