LowFinder Operations & LowFinder Bot Channel

What is LowFinder (LFI)?

LowFinder is the primary store of value liquidity layer for TREAD. The silver to TREAD's gold. But that is only it's primary function. LowFinder's job is implied in the name: LowFinder tracks, identifies, and buys low price movement in Storm of Value assets (https://donttreadtoken.com/index.php/tread-lfi-storm-of-value-rewards), and relays the information gathered from low rate movement back to investors.

How does it work?

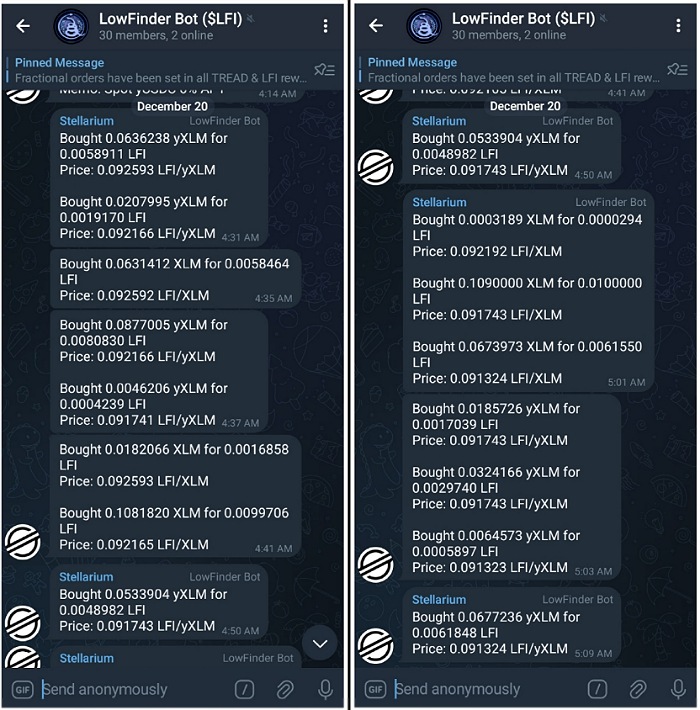

LFI orders are placed on the Stellar DEX at key movement points in all of the Storm of Value Rewarded assets. When SOV assets experience low rate movement, LFI orders are processed. The LowFinder Operations address processing these orders is connected to the LowFinder Bot Telegram Channel through Stellarium Bot https://t.me/LowFinderBot. The info on orders processed is public for those who join the channel, and will relay low rate movement directly to investors using the fastest means available: direct DEX communication.

For more info on setting up your own Stellarium Bot, please see our tutorial at https://donttreadtoken.com/index.php/how-to-set-up-stellarium-bot

Example Explanation:

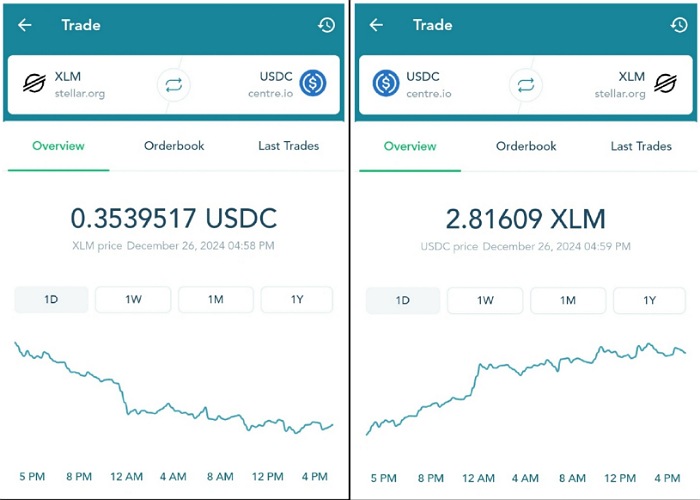

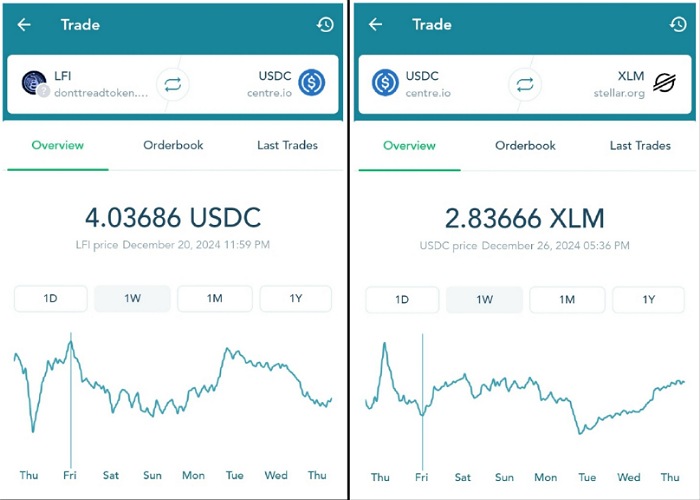

First we'll gather a general consensus of the market. Pictured above are the 24 hr rates of XLM/USDC & USDC/XLM. As you can see, they are mirror reverse images of one another. As the rate of XLM decreases, USDC is worth more XLM in value. During this point in the market, we are currently in a "consolidation" period of bull run. Where the rate of XLM is stabilizing and heading lower in USDC value to find it's support range.

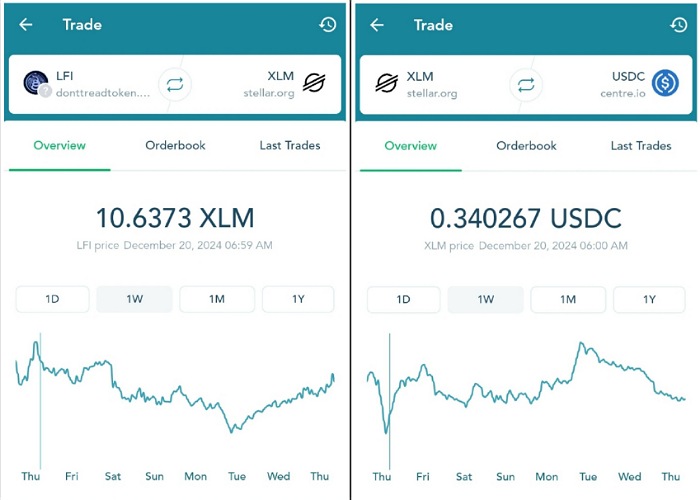

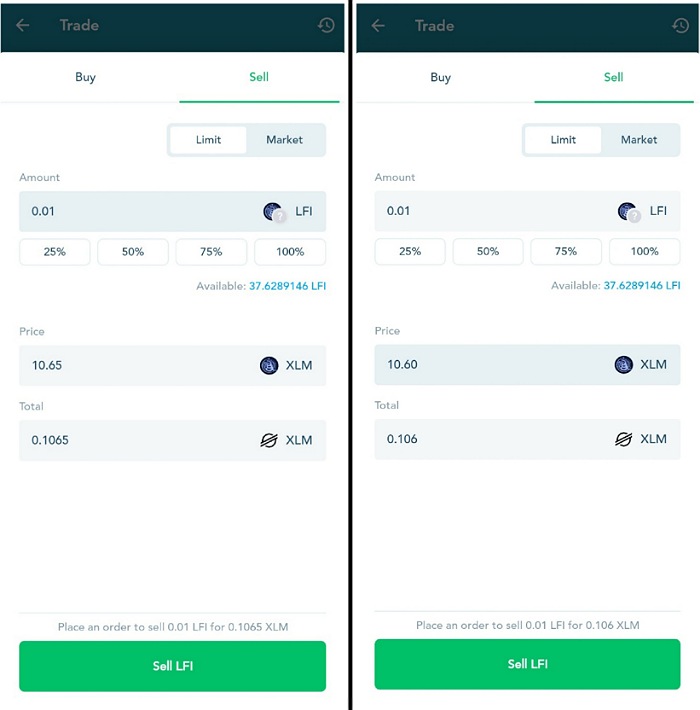

After hitting the 1 week chart we can find the weekly low range during this consolidation period. In this instance we can see that on the 20th of December we had a decent dip in XLM at roughly .34 cents. When we look in on the weekly LFI/XLM chart, we see a matching spike in the amount of XLM LFI is worth. Around the 10.60 range. We will use that number as the beginning of the order ladder we'll create to capture low XLM movement.

We'll ladder orders by staggering the rate upwards from the weekly low range. Starting at 10.60 XLM, and moving it upwards .05 XLM at a time. It doesn't always need to be .05 XLM. If I anticipate more radical movement , I might place orders .1 XLM apart. Obviously these rate spacings are going to be different in every asset, depending on what it is.

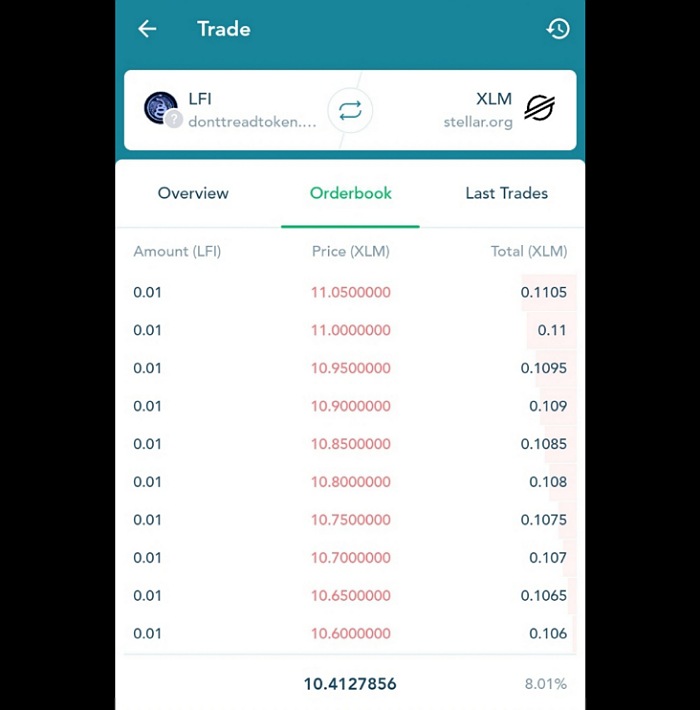

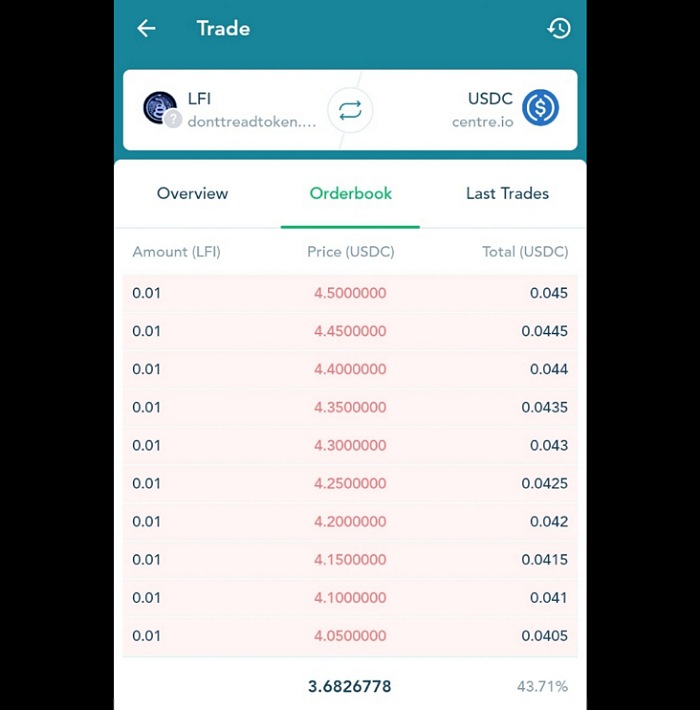

Here we can see the full order ladder in action. Orders will start hitting when XLM is in the .34 cent range. If XLM dives past .34 cents, the order ladder will notify investors through the LowFinder Bot Channel.

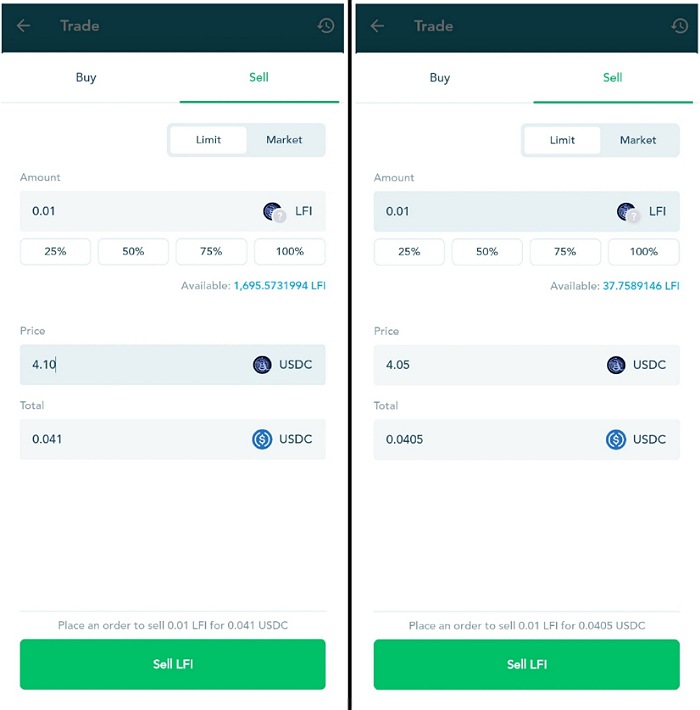

Orders in current market conditions are set for .01 LFI. These are meant to be fractional orders that simply pass through LowFinder rate and don't stand to impact it whatsoever. In bull market conditions I like to operate manually through being notified of orders, and moving accordingly. In more bearish conditions there are more incentives to change these orders from .01 LFI to something like .1 LFI. In bear market I'll set the orders to buy more of the low, and also operate manually to shift liquidity into these lows. The goal is accumulation; knowing with age the market will continue to increase in overall value.

One last note about these order ladders: the more .01 LFI orders you see being processed in LowFinder Bot Channel, the deeper the low rate movement. You might see a tickle of an order at .005 LFI. That's a clue to start monitoring the asset or to buy in lightly. If you see a string of .01 LFI orders pass through the channel, that's your cue to start buying the more radical low rate movement.

Here we have our next sample of weekly market movement taken from USDC. We can see the high for the week in LFI/USDC value is around 4.05. We will start the ladder here and upwards in USDC rate. When USDC orders hit it will signify a rise in the market, and a good point to lightly stock USDC for the next drop in market.

On the extremely rare occasion, stablecoin orders hitting can mean a depegging from the pegged rate of said stablecoin value. Depegs are one of the best opportunities to stock up stables, as stablecoins have a responsibility to maintain their pegged rate. Utilize depeggings for easy money.

USDC orders are spaced out in .01 LFI at increments of .05 cents. You might be asking why the order spread is further apart in USDC, when .05 XLM is roughly .02 cents. The reason being the goal here is accumulation of Stellar and Stellar assets; while anticipating bull market conditions and knowing the market will climb. We want to sell less LFI into USDC (so as to not sell ourselves short) and focus on buying more XLM and Stellar assets when dips occur.

Pictured above is the full USDC order ladder. When stablecoins like USDC, yUSDC, EURC or metal orders start flowing, it most often signifies a boom in the market. Quite often BTC, yBTC and ETH, yETH orders operate similarly unless there's some really radical low rate movement from them. Many times when BTC or ETH orders start hitting it's due to the rate of XLM or LFI skyrocketing on their own. A quick glance at the rates of all these assets should paint the picture.

Pictured above we have the results from the movement in XLM I pointed out from the 20th of December. As we can see, long strings of orders from XLM & yXLM movement were processed, signifying the radical low rate movement we saw in the XLM chart.

In this example we've covered XLM and USDC movement in operations with LFI, but keep in mind these order ladders are set in all Storm of Value assets.

TREAD Orders:

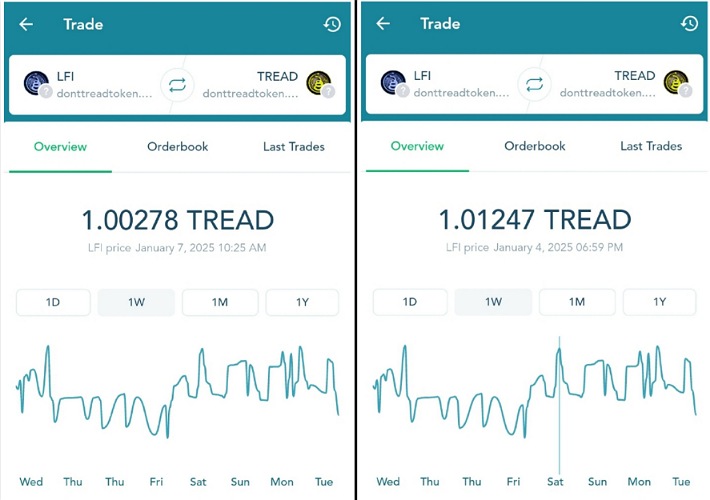

Pictured above, TREAD orders operate a bit differently than the rest of the Storm of Value assets. As the rates of LFI and TREAD are loosely pegged to one another, the system allows for a bit of arbitrage opportunity. If you see TREAD orders being processed in LowFinder Bot Channel, it's due to the rate of TREAD being slightly lower than LFI; allowing room for investors to make trades between the two, and utilize the difference in rate to their advantage.

In Conclusion:

Understanding and utilizing LowFinder Bot Channel can be one of the best tools in your arsenal when market movement occurs. Combined with TREAD & LFI Storm of Value Rewards https://donttreadtoken.com/index.php/tread-lfi-storm-of-value-rewards and liquidity shifting https://donttreadtoken.com/index.php/tread-lfi-storm-of-value-rewards-market-movement-liquidity-shifting, LowFinder Bot Channel is key to building your interest earning structures through taking advantage of opportunities the market provides.

For further questions please cruise the rest of our site and join https://t.me/libertycryptosyndicate