TREAD & LFI Storm of Value Rewards

At Liberty Crypto Syndicate we've spent years building out TREAD through all market conditions, laying a solid foundation of structured liquidity in over 150 assets. LFI was built behind the scenes as a solid secondary liquidity layer; and was released publicly on Jan 1st 2024.

Both projects are loosely pegged to each other and operate in symbiosis. Building each other upwards in rate and outwards in liquidity, regardless of which direction the market is heading.

A true store of value structure.

Rewarding Liquidity Providers

On Jan 1st 2024 we began building our own rewards structure tied into TREAD & LFI. Liquidity providers are rewarded for pooling select assets in both projects. Rewards are paid out in hourly, daily, and monthly amounts in TREAD & LFI (depending on the project you are pooling and the minimums listed). All project related wallets are excluded from rewards.

On March 1st 2025 we began a Partnership Program for Storm of Value Rewards that expands the system and incentivizes building partners and assets who meet the requirements. For more information about our Partnership Program, see our page at https://donttreadtoken.com/index.php/storm-of-value-rewards-partnership-program

TREAD & LFI Storm of Value Rewards

TREAD and LFI are rewarded hourly, daily, and monthly as follows:

Hourly:

With the passing of Proposal #4: Storm of Value Rewards Expansion, all TREAD and LFI SOV pools are rewarded daily distributed hourly based on tier level.

Tier level operations are as follows:

- For every 20 TREAD or 20 LFI added to the overall pool (total, not individual) an additional .025 TREAD or .025 LFI is rewarded daily distributed hourly.

- Pool participant rewards are based on total tier level and percentage of pool held.

- Pool tier levels are uncapped in levels attainable.

- All TREAD & LFI in rewarded pools count towards individual monthly rewarded tiers.

For more info on TREAD and LFI Storm of Value daily distributed hourly tiers, see Proposal #4 link at https://donttreadtoken.com/index.php/proposal-4-storm-of-value-rewards-expansion and for information on adding an asset to our Storm of Value Rewards, visit our Partnership Page at https://donttreadtoken.com/index.php/storm-of-value-rewards-partnership-program

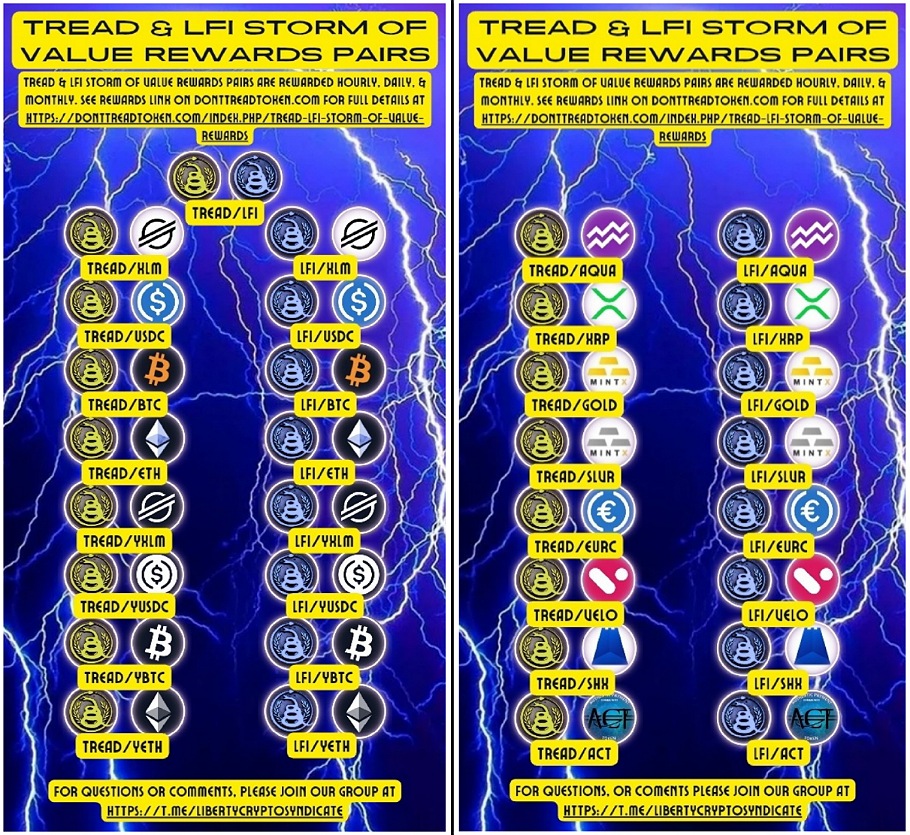

TREAD is rewarded daily distributed hourly based on total pool tier level and individual percentage of the following pools:

TREAD/XLM (stellar.org)

TREAD/USDC (centre.io)

TREAD/EURC (circle.com)

TREAD/BTC (ultracapital.xyx)

TREAD/ETH (ultracapital.xyz)

TREAD/yXLM (ultracapital.xyz)

TREAD/yUSDC (ultracapital.xyz)

TREAD/yBTC (ultracapital.xyz)

TREAD/yETH (ultracapital.xyz)

TREAD/AQUA (ultracapital.xyz)

TREAD/XRP (ultracapital.xyz)

TREAD/GOLD (mintx.co)

TREAD/SLVR (mintx.co)

TREAD/VELO (velo.org)

TREAD/SHX (stronghold.co)

TREAD/ACT (authentic-payment.com)

TREAD/Apay (authenticpayment.stellarmint.io)

TREAD/SVR (svr.xmint.io)

TREAD/SIG (solarisgood.fredenergy.org)

TREAD/SAVE (savetoken.net)

TREAD/VAQM (vaqm.io)

TREAD/AXLM (authentic-payment.com)

TREAD/XTAR (dogstarcoin.com)

TREAD/BRAINFROG (xlmeme.com)

TREAD/Fucupcakes (fucupcakes.xmint.io)

TREAD/ASSHAT (lu.meme)

TREAD/LIBRE

LFI is rewarded daily distributed hourly based on total pool tier level and individual percentage of the following pools:

LFI/XLM (stellar.org)

LFI/USDC (centre.io)

LFI/EURC (circle.com)

LFI/BTC (ultracapital.xyz)

LFI/ETH (ultracapital.xyz)

LFI/yXLM (ultracapital.xyz)

LFI/yUSDC (ultracapital.xyz)

LFI/yBTC (ultracapital.xyz)

LFI/yETH (ultracapital.xyz)

LFI/AQUA (ultracapital.xyz)

LFI/XRP (fchain.io)

LFI/GOLD (mintx.co)

LFI/SLVR (mintx.co)

LFI/VELO (velo.org)

LFI/SHX (stronghold.co)

LFI/ACT (authentic-payment.com)

LFI/Apay (authenticpayment.stellarmint.io)

LFI/SVR (svr.xmint.io)

LFI/SIG (solarisgood.fredenergy.org)

LFI/SAVE (savetoken.net)

LFI/VAQM (vaqm.io)

LFI/AXLM (authentic-payment.com)

LFI/XTAR (dogstarcoin.com)

LFI/BRAINFROG (xlmeme.com)

LFI/Fucupcakes (fucupcakes.xmint.io)

LFI/ASSHAT (lu.meme)

LFI/LIBRE

Daily:

Daily rewards are ONLY paid in the TREAD/LFI pool and are distributed at random per 24hr period.

TREAD/LFI daily rewards are based on tier levels:

- For every 30 TREAD & 30 LFI added to the overall pool, .025 TREAD/.025 LFI is paid daily to pool participants.

- Pool participant rewards are based on total tier level of the TREAD/LFI pool and percentage of pool held.

- TREAD/LFI pool is uncapped in tier levels attainable.

- All TREAD & LFI in the TREAD/LFI pool counts towards individual monthly rewarded tiers.

Monthly:

Tiers are in place for monthly minimums starting at 10 TREAD and/or 10 LFI in ALL rewarded pools. ONLY THE TOTAL TREAD & LFI IN ALL REWARDS POOLS ARE COUNTED TOWARDS MONTHLY MINIMUMS. Both assets are counted separately towards their respective tier percentages.

The tier structure for monthly rewards are as follows:

100 minimum = .5% = 6.17% APY

80 minimum = .4% = 4.91% APY

60 minimum = .3% = 3.66% APY

40 minimum = .2% = 2.43% APY

20 minimum = .1% = 1.21% APY

10 minimum = .05% = .605% APY

Tier brackets reward the % of the tier minimum you qualify for. APY percentages do not compound as you gain higher minimums, but you'll achieve the higher APY tier. After the 100 minimum is reached, you can continue to gain at .5% uncapped exponentially.

For the specific TREAD/LFI pool, both assets count towards your minimums in each. 10TREAD/10LFI would reward .05%/.05% for the month in each asset. 100TREAD/100LFI would reward .5%/.5% in each asset.

Monthly rewards are based on an average of TREAD & LFI pooled for a month period. Monthly rewards are paid on the 1st of every month.

Summary

By incentivizing the community to provide liquidity to TREAD & LFI, we are building a solid store of value liquidity layer for Stellar Lumens network. In return, both assets operate as a decentralized interest structure rewarding participants growing our ecosystem. For further comments, questions, and clarity, please join our Telegram group at https://t.me/libertycryptosyndicate